How is Fire actually going to work?

When first hearing about Fire, my mind was opened up to a new light. Disillusioned by the 9-5:30, 3 hour round commute everyday for the rest of your life until you're a shrivelled up prune. I now had the way to escape this.

At the point of discovering Fire I was adamant I would achieve this through intense frugality whilst still being on a modest income at the time. I would be alone forever and my costs would never change in real terms (adjusted for inflation), even though we was in the middle of the pandemic. Even when going away, I would only ever go and stay at hostels and travel on a backpacker budget like some real life Peter Pan. No issues right....

Now a few years have passed and more life experience has been gained, this isn't quite what the reality will be. But this time has proved that it is almost impossible to predict what will happen the future. However, there is still every reason to try and put yourself in the best position possible with the hand you are dealt. It's also quite fun tbf.

Looking at this I have categorised my financial lifespan into 4 separate stages with differing needs given my age and life position:

The Strategy

Stage 1 - Accumulation Phase

In this section I have been and will continue to work full time, be mindful on spending, to earn more than I spend, create a surplus and invest this in index funds, on top of what I have already invested into my Stocks and Shares ISA.

Whilst I'm calling it the accumulation phase, this won't be the case in all the years. In late 2025 we are hoping to do a working holiday over in Australia and travel through a few countries whilst we are on the way to and back from our trip, so in these years a surplus in savings will not be the case.

Also in this period I will look to purchase a primary place of residence (home, not an investment), which will be a large amount of the portfolio being put down for an initial deposit, then increased outflows paying off the mortgage going forwards.

Stage 2 - Mini Retirement/Coast FIRE

By this stage my portfolio should be big enough that I will be able to ease off the gas workload and use some of the wealth I have accumulated to buy gain some more freedom in my life to enjoy it as much as possible.

This might be in the space of taking a part time job or fill fixed term contract roles, then take a few months off to to some travelling in the gaps. I have spoke about the different Fire methods that could be taken in this post.

In this stage my Fire Portfolio will be going down as I access some of the funds within this coming from my Stocks and Shares ISA and Cash Reserves. I am hoping to keep enough within this to bridge the gap until I can access my private pension.

Stage 3 - Access to Private Pension

With the stocks and shares ISA taking a bit of a battering in stage 2, having the ability to access my private pensions will be a warmly welcome. I am not aiming for this pension to be too high for the primary reasoning that I want to be able to access more of my funds earlier, so focus on putting my savings into the ISA. Whilst pension contributions are tax free, the withdrawals are part of taxable income, so I don't want the pension becoming tax inefficient if it becomes too large.

At this stage the mortgage should be paid off so this will mean a large reduction in my cash outflows, also easing the burden of my portfolio. Fingers crossed I will still be healthy enough to be active and able to have some adventurous holidays and enjoy nature at the early part of this stage.

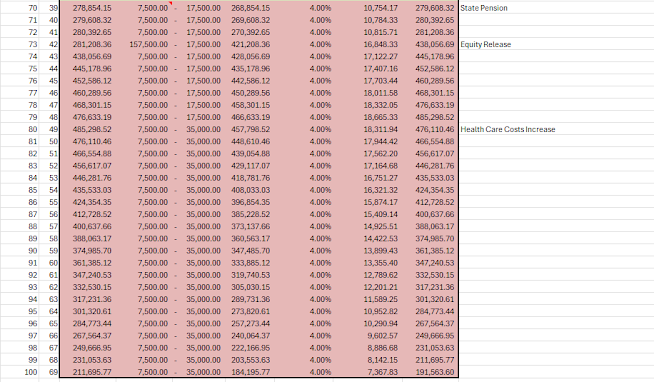

Stage 4 - Access to State Pension and Equity Release

Putting this into the calculation was morbid, planning for the end of your own life,. That's even despite generously planning to live up to the age of 100 (First century I'd complete after years of failing as a batsmen). Carrying on the morbid theme, this stage would be the longest of the 4.

I would need to have enough to cover and long period of time and increased care costs if/when required. Given that I have been likened to Harry Maguire, for what I hope was my aerial ability, by some opposition this year (cheekily from someone who looked like Luke Chadwick), the damage from heading is food for thought of what I will be like in my later years. To cover the increased costs of care, I would look to release house equity at this stage.

By this point I will hopefully qualify to get a state pension in, even if not satisfying the full qualifying years I would look to received around 70% of the full state pension from the full time and part time work I have accumulated.

Scenario Example in Numbers and Assumptions:

Obviously it is extremely unlikely that the below will occur, but I would argue I have been extremely conservative on the numbers. Assumptions to the forecasting are explained below. I have also done a scenario as an individual and a second scenario with shared portfolio.

Cashflows adjusted for inflation

The Cash Outflows and Inflows are in real terms in today's monetary value. Increasing costs in line of inflation would make the example messy so I just wanted to avoid it.

Age

I have been very optimistic here to say I will live up to 100. Whilst there's no logic for thinking this, it is worthwhile planning with the assumption I will live a long life and want to be prepared for if this scenario was to happen.

Growth Rate

The growth rate used in this scenario is 4% after inflation, in line with Mr Money Moustache's post as linked here. Whilst past results are not a reflection of future earnings, 4% seems pretty conservative, especially in the accumulation phase where dividends will be reinvested and returns have been higher historically. The growth rate in my scenario is based on the end of year position, which again is more conservative than what is likely to happen in reality.

For perspective below is the results of some the global index tracker I use and the MSCI Index Tracker over the years. Clearly the returns fluctuate and are hardly ever at 4%, but with no crystal ball, 4% is the constant rate used in this scenario. If returns are weak at certain times, I'll try and work at these times and where it is stronger, I may look to use some of the surplus cash of the return to gain some freedom in good times.

Vanguard Global All Cap Returns Last 5 Years

MSCI Returns From 1979

Income

In terms of full time income, I have based this on the assumption that I will stay at my current seniority level and will not gain any promotions in this time, and income going up in line with inflation. This is being on the conservative side of forecasting. In the couples scenario, I have even thrown in a few maternity income years just to have a play about (can picture the GF's face cringing as she reads this haha)

For my part time income years aiming for 2/3 days work a week, again I have put a conservative amount of income. I am unsure if this would be part time income or contract jobs in my current line of work, or if I would move into a different field. It'll be more likely I will be filling in for maternity posts so 9 month positions and 3/6/9/12 months off at a given time.

Not factored in to this scenario was any inheritance that might be received in this time. I'm not sure what or when such inflows would be included so have left out.

Expenditure

Expenditure totals input are below what are suggested by the retirement living standard website. Looking through this and my prior spend, I would class myself somewhere in between the minimum and comfortable spend bracket, and have factored my spend accordingly with fluctuations at different times.  Pension Access Ages and Values

Pension Access Ages and Values

The Pension Access Age may change due to government policies put in place, so the risk of these being altered is reasonable. With an aging population, the voting power of pensioners is quite strong, so it's unlikely that there will be drastic changes to the policy. However, I have increased my access age for both Private Pension and State Pension by a few years compared to the current access ages.

Example 1 - As an Individual

Example 2 - As a Couple

Comments